- Business

- Investing

- SEE MORE

- classical

- general

- talk

- News

- Family

- Bürgerfunk

- pop

- Islam

- soul

- jazz

- Comedy

- humor

- wissenschaft

- opera

- baroque

- gesellschaft

- theater

- Local

- alternative

- electro

- rock

- rap

- lifestyle

- Music

- como

- RNE

- ballads

- greek

- Buddhism

- deportes

- christian

- Technology

- piano

- djs

- Dance

- dutch

- flamenco

- social

- hope

- christian rock

- academia

- afrique

- Business

- musique

- ελληνική-μουσική

- religion

- World radio

- Zarzuela

- travel

- World

- NFL

- media

- Art

- public

- Sports

- Gospel

- st.

- baptist

- Leisure

- Kids & Family

- musical

- club

- Culture

- Health & Fitness

- True Crime

- Fiction

- children

- Society & Culture

- TV & Film

- gold

- kunst

- música

- gay

- Natural

- a

- francais

- bach

- economics

- kultur

- evangelical

- tech

- Opinion

- Government

- gaming

- College

- technik

- History

- Jesus

- Health

- movies

- radio

- services

- Church

- podcast

- Education

- international

- Transportation

- Other

- kids

- podcasts

- philadelphia

- Noticias

- love

- sport

- Salud

- film

- and

- 4chan

- Disco

- Stories

- fashion

- Arts

- interviews

- hardstyle

- entertainment

- humour

- medieval

- literature

- alma

- Cultura

- video

- TV

- Science

- en

Markets Are Dangerous For Investors

Here\u2019s our new financial reality, which we have become all too familiar with: higher inflation, higher interest rates, and higher levels of debt among consumers, corporations, and governments, which all add up to significantly higher costs of doing business, living life, and borrowing.

\nTo fight higher inflation, the Federal Reserve continues to hike short-term interest rates.

\nThis week\u2019s guest has experienced multiple economic and market cycles during his more than 50 years of managing money and thinks the current one is particularly perilous for investors. In an exclusive WEALTHTRACK appearance, he felt it was important to tell us why and what steps we should consider taking to mitigate its effects.

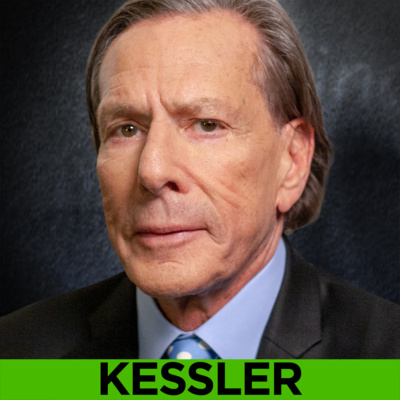

\nRobert Kessler was the CEO of his namesake Kessler Companies from its founding in August of 1986 until he made the decision to close the business in October 2021. Until then, he was a manager of fixed-income portfolios, specializing mostly in strategies using U.S. Treasuries for institutions and high-net-worth individuals around the globe.

\nHe has been an annual WEALTHTRACK guest since our launch in 2005 and one of our most popular ones. He has been a consistent critic of Wall Street practices and group think, and for decades has been particularly disparaging of the Street\u2019s consensus that Treasury bonds were an expensive and dangerous investment sure to bring losses to investors.

\nRobert Kessler explains why he thinks the markets are so dangerous for investors right now. A long-time critic of Wall Street and its pervasive groupthink.

\nWEALTHTRACK 1919 broadcast on November 04, 2022

\nMore Info: https://wealthtrack.com/the-financial-markets-are-perilous-warns-robert-kessler/

\n\n--- \n\nSupport this podcast: https://podcasters.spotify.com/pod/show/wealthtrack/support