830: On the Road to Baku. Enormous Chinese bond debt, some defaulting. @acollier @GordonGChang

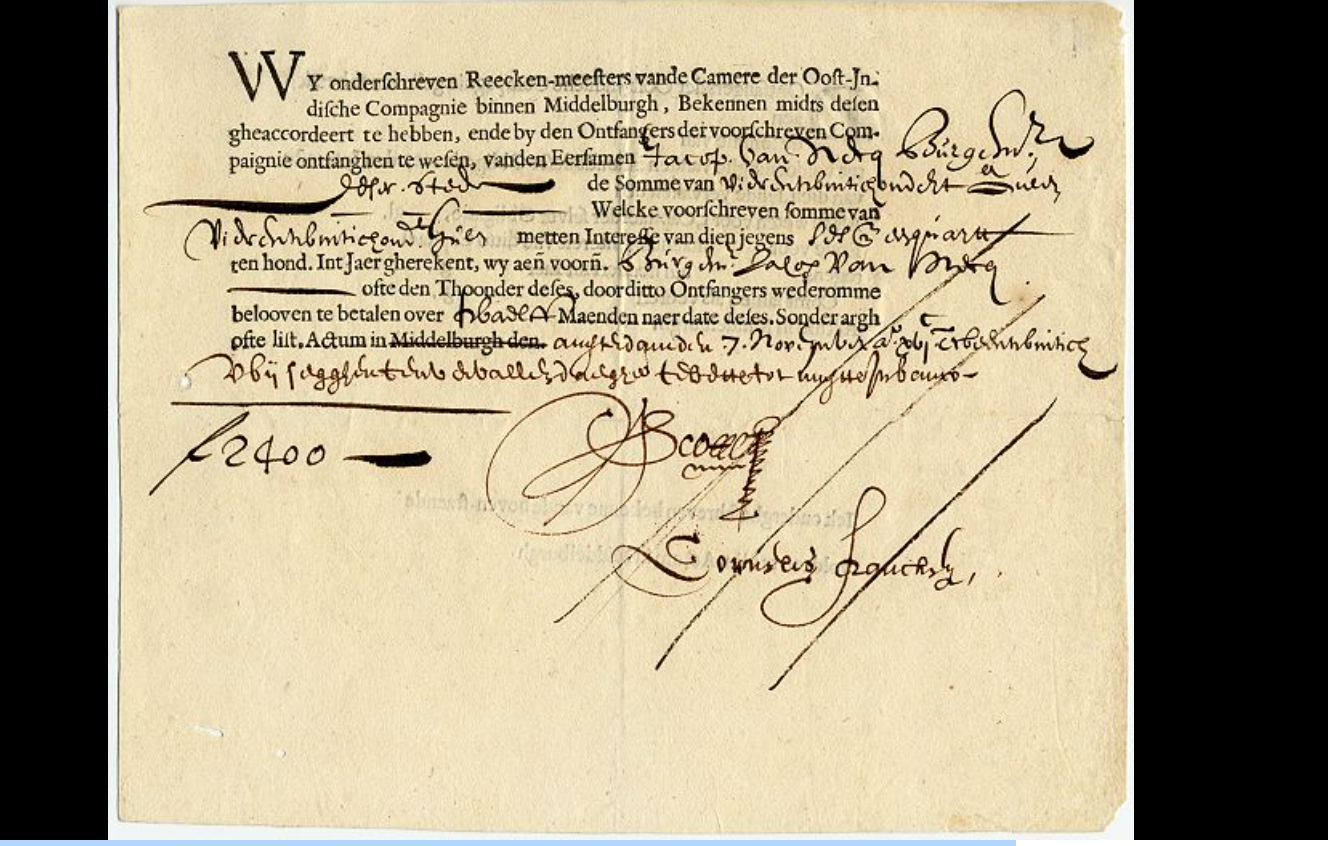

Image: Vereinigte Ostindische Compagnie bond. A bond of the Dutch East India Company, dating from the 7th of November 1622, for the amount of 2400 guilders, with an annual interest of 6¼ percent.* On the Road to Baku Wednesday 9 December 2020 / Hour 1, Block A: Andrew Collier, @acollier, managing director of Orient Capital Research based in Hong Kong, and Gordon Chang: @GordonGChang, Daily Beast, in re: Chinese defaults. Baku on the Caspian seashore. There’s great bad debt in China—bonds won't be paid, or will blow up. Why is Beijing allowing some companies to default? Will China implode? Three proposed remedies. Some state-owned forms are defaulting; what was happening was that localities owned inefficient companies; the central government allowed default. West has about $150 billion of bonds. This is really signaling by Beijing: You gotta stop wasting [stealing] money. Next year, if here are too many defaults, investors would stay away. In some cases, recapitalization by banks, local state firms, etc. Authoritarian regime with interference all over the place. We’ve now seen orderly court defaults rise from 15,000 to 19,000. Private firms, incl Evergrand (enormous real estate company) in Shenzhen, had $150 billion in debt, couldn’t repay. Some sort of recapitalization package occurred. A messy, Western-style retrieve. The government is introducing failure, which is a form of capitalism. The memorandum carried by GlobalSource Partners https://www.globalsourcepartners.com/posts/defaults-in-china/teaser CHINA ADVISORY - Report 30 Nov 2020 by Andrew Collier The recent wave of defaults has raised questions about China’s support for the state sector. It is unusual for Beijing to allow state firms to default on their bond or debt obligations, which opens the possibility of a failure of the state sector, and thus a risk to the economy from a systemic collapse of bond obligations. This is an unlikely outcome. China is simultaneously increasing credit to the economy through the banks while squeezing those sectors it believes are inefficient consumers of capital as a signal to the market. Widespread defaults are unlikely to occur, but if a chain reaction begins, Beijing would step in quickly through the PBOC or state proxies and halt the increase in defaults. The pressure for capital by local governments is high, however. Land sales are weakening and local debt is unsustainable. We can view China’s approach to economic restructuring and the implicit government “put” as a three-part policy: 1) Strengthen the court system to handle corporate defaults. 2) Make known its declining support for inefficient – mainly local – state firms that are squandering credit and increasing implicit government debt, through “signalling.” 3) Flood the banks, particularly the larger ones, with adequate liquidity to handle loans to corporates, including targeting the cash-short SMEs. . . . .. *This bond was issued in Middelburg, but signed in Amsterdam. Translation: We, the undersigned accountants of the East India Company in Middelburg, hereby make notice to have accepted, and to have received through the receiver of the afore-mentioned company, from the right honorable Jacob van Neck, mayor of this city, the sum of twenty-four hundred guilders. We promise the afore-mentioned mayor Jacob van Neck, or the bearer of this (document), to pay out through ditto receiver, in twelve months time from today, the afore-mentioned sum of twenty-four hundred guilders. With the interest of this sum being rated at six and a quarter to a hundred (6¼ %) over (a period of) one year. (This being agreed) Without bad intent or deceit. Done in Middelburg on the Amsterdam, on the 7th of November, 1622. We promise to pay out (dividend) at the due date (of this bond) through our bank in Amsterdam. ƒ2400 Not legible (signature) Cornelis Francken (signature)