1038: Private enterprise innovates. @johntamny

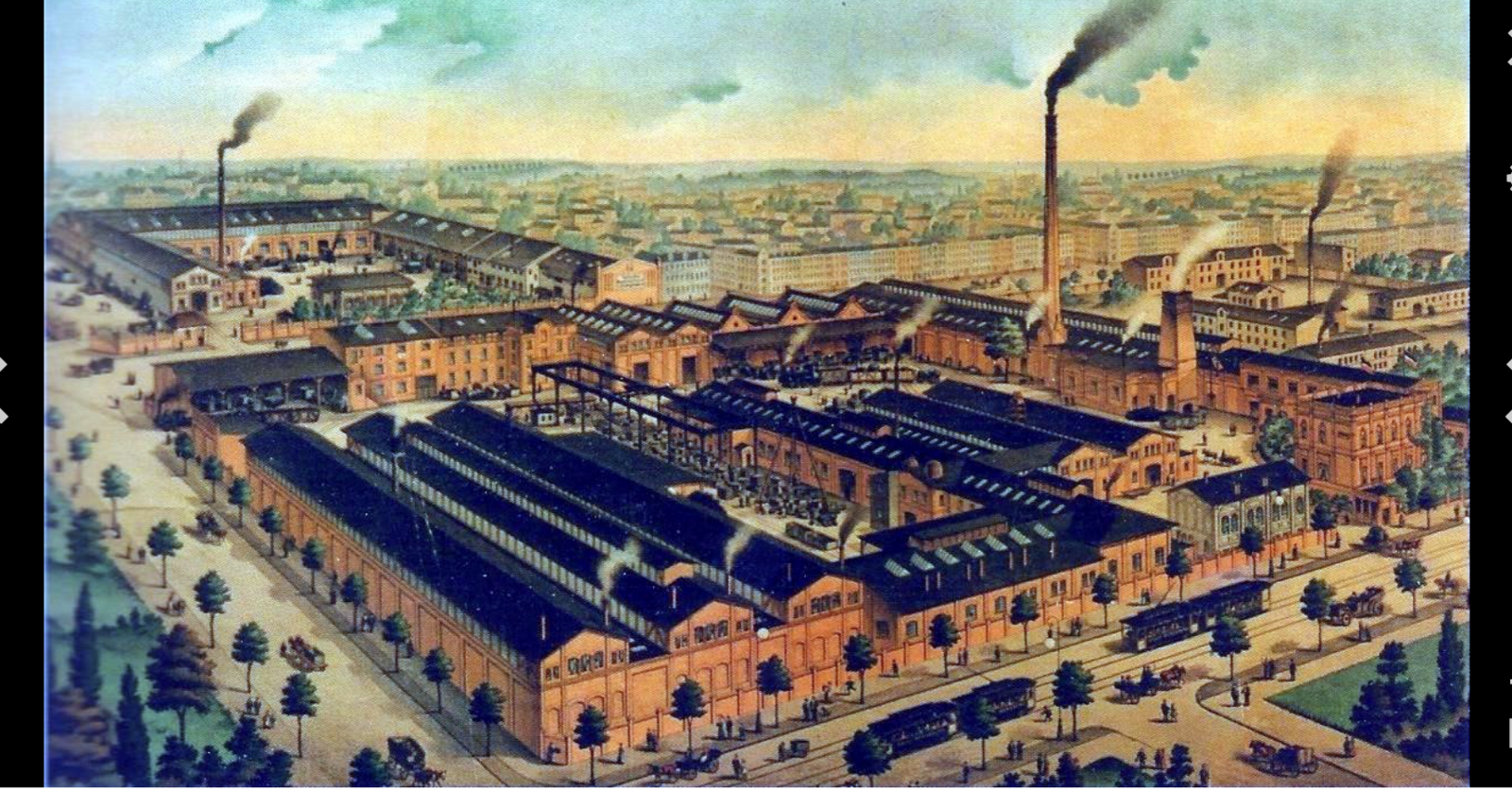

Image: Factories and corporations are considered private property John Tamny, @johntamny, RealClearPolitics, author, When Politicians Panic; in re: Hewrote that Trump sensed voters felt weak in face of global elite with unimaginable power. Bezos spends tens of billion a year to find new ideas. Google employees wrote to the firm’s president objecting to Google’s doing business with the Pentagon. You can't afford to offend your employees—the power is too ephemeral. AOL is now a laughline. FAANG CEOs know exactly how ephemeral their power is. Bitcoin (which a friend has called “tulipmania without tulips”): Money is just a measure, like one foot or one cupful. Real currency’s value is unchanging. Gold will always speak its mine. Bitcoin’s volatility magnifies the dollar’s worst qualities. .. Gerard Baker writes that Donald Trump "succeeded in large part because he spoke to the frustrations of so many Americans who have been disdained and discarded by a global elite that enjoys unimaginable power and privilege." The routinely excellent Baker missed it there. The "global elite" he was plainly referring to are the technology giants that supposedly disdain Trump's base, but Baker forgets that absent Facebook and Twitter, Trump arguably isn't president to begin with. Their size is the surest evidence of how little they disdain the everyman, at which point it's worth pointing out that no "Big Tech" company CEO thinks his company has unimaginable power. They invest tens of billions each year in new ways of meeting the needs of their users precisely because market power is ephemeral. If you have a problem with "Big Tech," cheer their success. High achievement begets the very investment that will result in those at the top being replaced. The opinion piece can be found here (http://r20.rs6.net/tn.jsp?f=001gyc3S435x9x1Om5Sv5t_L9ZgJNjyh3c0JNK3hb9zC0cRpdsPKHfm1VnS6CKsPsXLDGE8PTO6KvkhVynIPtesNb-JT4ooeqjv_WPCprg-WORwQbPdLoGf9pt09FexSKwwiMsDz8_ZUbFTkZsJhOP00I8njQaj5IM9sduMAPDTQ4fhUvCqD5TkmA2spJeEY5H_VWV00U4DCf7RBVr2vvNBIQyrki6cZLM3si4hnf22pLLOoc94ghX0FjOR3SYHJaxNZAw5x8dgyia4d6-mnSpprMZlrdiJEo4U&c=2aDfxZ8lNjer19o1Hufp9CpKiVcYx4CNu8z8OyXf205MBgZTZkoDxw==&ch=JE9xdoG2wH7jqksHCeRYFf3JD5KDUJLePA7x4rS1vGwmIVz6WvbRDg==) . As always, no one buys or sells with money, they're not paid in it, nor do they borrow or lend with it. Underlying all monetary transactions is the movement of real resources. Money is a low-entropy measure, as in an agreement about value that moves real things around. That's why Bitcoin is a speculation as opposed to its being money. As evidenced by the private money's extraordinary volatility that magnifies the dollar's worst qualities many times over, transactions with Bitcoin as the referee would result in aggrieved winners and losers nearly every time; meaning Bitcoin's present, heavily discussed existence is a sign that it's not money. Real money is quiet precisely because its value is stable. The opinion piece can be found here (http://r20.rs6.net/tn.jsp?f=0017CqfOayu_CLsRhCMZUxrm4oyYaKlqZ1k0rvdamKYuN4QE4kbSqxu8Kg6dby2Saywl6m1BBWCBIL7CYtgz--fKNe7pc1DzHC2ZAeUpC-oP3xX3q2ZgjqDy6DqGQgrBlH44to7jFjJkCAQfYh_PljdWdarrAKuwJilG3udevlGoTMQ753kS3wPUI4fJ1iF5EdxYspnIIHJJNeZHZCXFEO0pZWBvW25oaBS-dct-vP1_yrIEYeAQZfsYtb4BkhkwNRpwHWpJ3UVhFH18nLEep_VAq-5AmBzHrEPr6msURif-rx3T1VW10vRfaAZl8HKylAZ&c=HS3XmCtFTSPvEYE4aIidwSJBcYhS3TPZcyy0yCJmrt4sxZVOiG17SA==&ch=1RaG3SEPwQ4trj6navvZwz3ajSVV8BWXG8HYo1XD4JLGtewmKVp1kw==) .