1000: Here comes Payroll Protection Program 3.0. @GENE MARKS

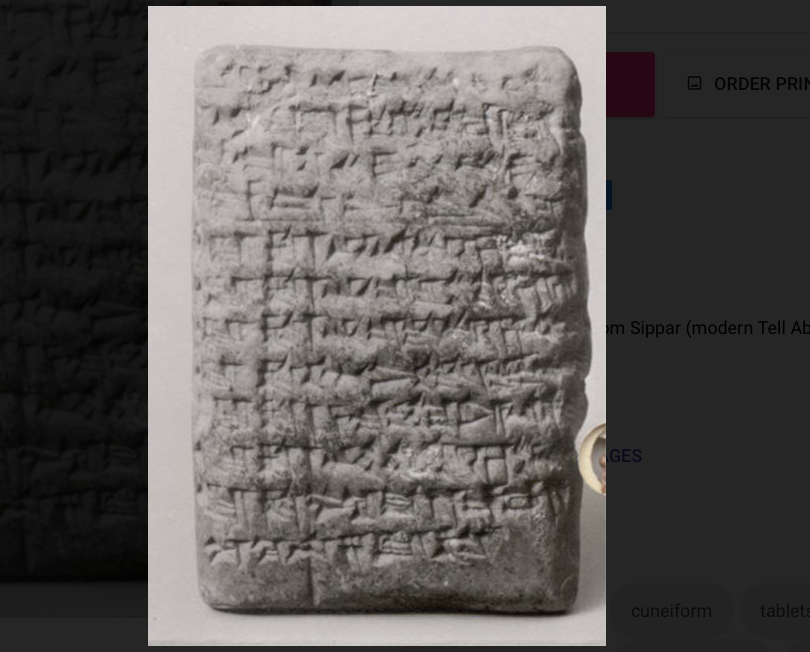

Image: Cuneiform tablet: account of wage payments, Ebabbar archive MACRO PPP reopens its doors this week. Here are 8 things small businesses need to know. https://fusion.inquirer.com/news/ppp-loans-small-business-covid-new-round-rules-how-to-apply-20210111.html Besides PPP, there’s another forgivable loan program for small businesses thanks to the new stimulus bill https://fusion.inquirer.com/business/small-business/stimulus-ppp-loan-sba-debt-savings-restaurants-hotels-20210105.html Nearly half of America’s states are increasing their minimum wage in 2021 https://www.economist.com/graphic-detail/2021/01/05/nearly-half-of-americas-states-are-increasing-their-minimum-wage-in-2021 Gene Marks, @genemarks @Guardian #SmallBusinessAmerica @Guardian, Philadelphia Inquirer, and at TheHill; in re: The first PPP did not use up all available funds; leftovers were returned to the Treasury. PPP returns, more targetted: have to prove you’ve been impacted by Covid—suffered a 25% loss of revenue in any quarter compared to that quarter in 2019. Have expanded definitions of forgivable expenses, now can include operational expenses—accounting, IT, technology; supplier contracts. Restaurants have quite a panoply. You can almost be automatically forgiven if your loan is less than $150.000. If you have fewer than 500 employees, can get a loan up to $5 million; principal and interest are forgiven if you get the loan before September 2021. The $15 minimum wage. The federal minimum is $7.50/hour. This all depends on where the wage is paid; argues against a federal minimum wage.