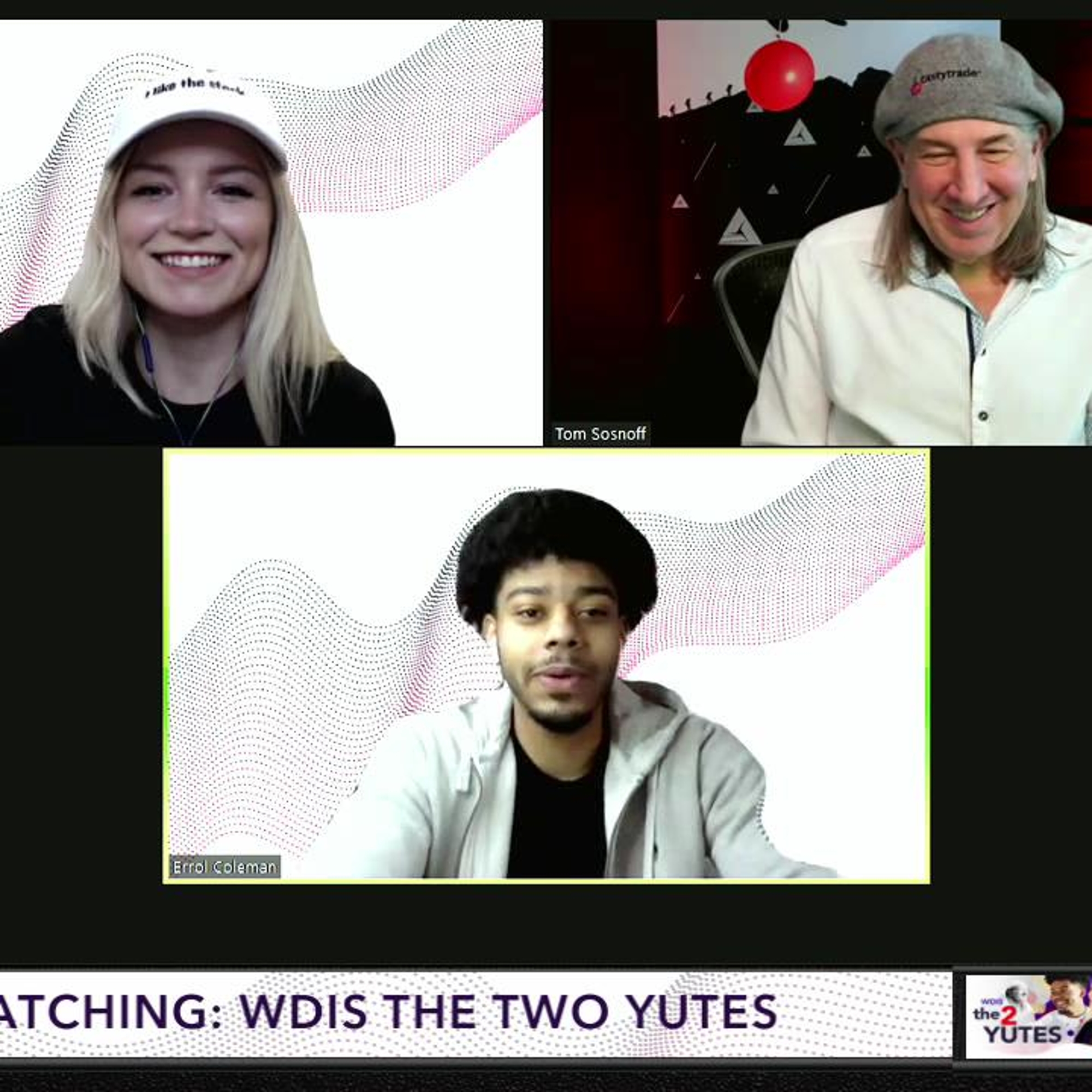

WDIS: Two Yutes - Beginner Options Trading - March 12, 2021 - The Skewed Iron Condor

Tom stresses that there are two reasons to take a position off--either the price moves your way, or the IV Rank drops really low. He reminds the influencers to continue to keep an eye towards high volume, liquidity, and relatively high IV Rank when looking for new trades.

Errol decides he’s feeling just a little bit bullish towards BIDU so Kay suggests a bullish skewed iron condor, a neutral-to-bullish defined-risk play.

Tom explains that there are actually TWO break even points with any Iron Condor. To calculate the...

- Put side break even, subtract the credit you’re collecting from the short put strike price.

- Call side break even, add the credit you’re collecting to the short call strike price.

Kay realizes that the further away you move your options from ATM (at the money), the less you collect, but the more intensified your delta becomes on that side.