The Value of a Strong Banking Relationship [THA 175]

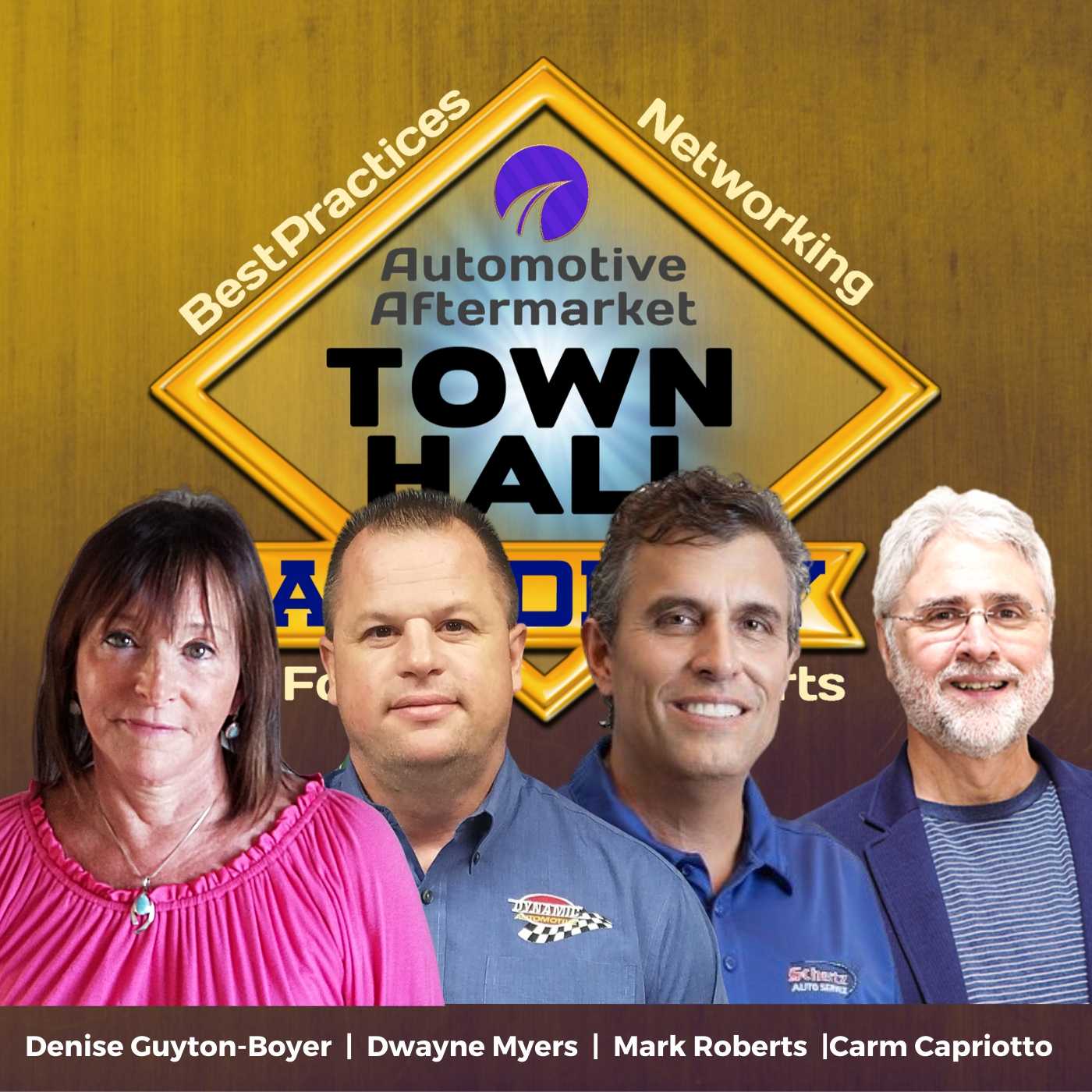

https://youtu.be/8I_6equiTFI The Panel: Denise Guyton-Boyer, SVP Commercial Lending, FCB a Division of ACNB Bank. Denise's banking career has included branch management, consumer and residential lending and commercial lending. She attended Community College, University of Maryland School of Banking, Xerox University of Commercial Lending. Mark Roberts is the owner of Roberts Properties, Inc, Managing Partner of Total True Automotive dba Schertz Auto Service, Craftsman Building and Renovation LLC. He is also partnered with a Local Custom Homebuilder. Mark is also the former owner of Auto Collision Works. He grew up in Schertz and has been a resident since 1969. Mark also serves on the Board at Shertz Community Bank, is a Board of Director of Guadalupe Valley Electric Cooperative, Guadalupe Valley Home Services Corporation, and the Guadalupe Valley Economic Development Corporation. Listen to Mark’s previous episodes https://remarkableresults.biz/?s=%22mark+roberts%22 (HERE). Dwayne Myers, Dynamic Automotive 4 Stores Frederick, MDShop Owner. Dwayne invests time in the industry with the Auto Care Association and serves on the education committee with CCPN (Car Care Professional Network). Dwayne was recently honored as one of only 17 outstanding individuals that qualified for the prestigious 2017 World Class Technician Award presented by The Auto Care Association and ASE. He is very passionate about hiring and sustaining a strong and engaged team. Listen to Dwayne’s previous episodes https://remarkableresults.biz/?s=%22Dwayne%20Myers%22 (HERE). Key Talking Points Dwayne’s banker, Denise Guyton-Boyer is his friend first and banker secondTrust is what the relationship is about It is good to have a strong relationship to help get through tough times The banks in your time should be calling on you even if you don’t do business with them Both Mark and Dwayne believe in the value of community banks vs. the big corporate (national) banksMore personalized and involved with your business As Covid-19 proved the relationship with your banker helped navigate the PPP loans with SBA. You do not want a transactional relationship. No matter the situation you want personal service Keep in touch with your banker. Talk to them about your business and our industry Your personal financial statement is very important to gain commercial loans. This helps the bank realize their risk with a personal guarantee. If you are looking for bank support you will need to provideBackground on your business Three years of tax returns Three years of personal tax returns A debt schedule and payments Financial statements Purpose of the loan Collateral for the loan Cash flow statement Mission statement Cash is king. Your banker can help mentor you to financial success to get you to the point where you can borrow money and we a risk they are willing to takeThe banker should work with you hand in hand to process and secure loans. Will help you consider SBA loans if you do not have enough cash or collateral Credit Unions are an option Mark has learned a lot since being on a banks board of directors and on the loan committee.He has seen all kinds of personal financial statements that tell all Dwayne says to always be truthful with your banker. A good month or bad share it all.Their bank did a video of Dynamic automotive. Watch it here: https://bit.ly/3dH9vim (https://bit.ly/3dH9vim) Denise gave Dynamic a second chance at lifeShe saw something in the business to help them In five years they have grown to four stores A business plan is important for a banker to know where the business is goingCash flow projections Work with your accountant. Your Accountant is part of your advisor family Have a solid relationship with your branch manager and their team Banks can offer:Credit cards Construction loans Mortgages Rehab loans Many businesses do not want to pay taxes and their Financial...